See your AI teammate in action now

Ready to make support faster, kinder, easier and help customers feel good about choosing you?

PS: Sales improves too...

No credit card required

14 days free trial

DIY or Guided setup

Ready to make support faster, kinder, easier and help customers feel good about choosing you?

PS: Sales improves too...

No credit card required

14 days free trial

DIY or Guided setup

A guide to banking AI chatbots, covering 24/7 customer support, core banking tasks, advanced capabilities like onboarding and fraud alerts, ROI metrics, security compliance, and deployment.

Manish Keswani

Summary by MagicalCX AI

Banking chatbots can automate up to 80% of routine customer interactions and deliver true 24/7/365 support, freeing human agents for complex, revenue-generating conversations while improving first-contact resolution and cutting handling time.

Think of a banking chatbot as your always-on digital teller. It's an AI-powered assistant built to handle customer service, answer everyday questions, and offer round-the-clock support. This lets customers get instant answers without ever having to wait for a human agent.

Imagine a bank teller who never sleeps, speaks any language, and can juggle millions of conversations at once. That's no longer science fiction; it’s the new reality with modern banking chatbots. They've evolved far beyond clunky, robotic responses and are now sophisticated digital partners for financial institutions.

This evolution is a direct answer to a massive shift in customer expectations. People today expect instant, personal support whenever they need it. Waiting on hold or being told to call back during business hours just doesn’t cut it anymore.

There's a common misconception that automation creates distance and feels impersonal. In reality, a well-designed banking chatbot actually builds trust. It does this by delivering accurate, consistent, and immediate help for the most common banking needs.

When someone can check their balance at 2 AM or get a quick update on a pending transaction, their confidence in the bank solidifies. That kind of reliability is the bedrock of a strong customer relationship.

The real job of a banking chatbot isn't just to answer questions—it's to eliminate friction. By handling the simple stuff instantly, it frees up both the customer and your human experts to focus on more complex, high-value financial conversations.

At the end of the day, bringing in AI chatbots is about raising the bar for what a banking experience should feel like. It shows a real commitment to being efficient, accessible, and truly focused on the customer.

For banking leaders, this technology is the key to unlocking huge operational efficiencies while delivering the modern, seamless service that customers now demand. It’s how banks stay competitive and relevant in a digital-first world.

The real magic of a banking chatbot isn't in some futuristic, complex task—it's in how it flawlessly handles the everyday, high-volume requests that clog up phone lines. Think of these as the bread and butter of banking support: simple, repetitive, but absolutely critical to get right. By automating these interactions, banks can provide immediate answers and let their human experts focus on the tricky stuff that requires a personal touch.

This shift changes the entire service dynamic. Instead of forcing customers to wait in a queue, you're giving them instant gratification. When someone just needs to know their account balance, they want that information now, not after fighting with a phone tree and listening to hold music.

The quickest win you'll see from a banking chatbot is its ability to nail the most common customer questions with lightning speed. These are the queries that account for the vast majority of calls and messages your contact center receives every single day.

Take a simple balance check, for example. The old way involved logging into an app or calling the bank. The new way? A customer simply types, "What's my checking balance?" into a chat window. The bot verifies who they are in a heartbeat and delivers the answer. It's that simple.

Here are a few practical examples of core tasks where chatbots excel:

By mastering these fundamentals, the chatbot becomes your first line of defense. It successfully handles the lion's share of incoming requests—up to 80% of all customer interactions—ensuring your human agents are saved for the moments they’re needed most.

This isn’t just about making things more efficient behind the scenes. It's about creating a better, more empowering experience where customers feel completely in control.

The difference between calling your bank and chatting with a bot is night and day. One experience is often defined by friction and waiting, while the other is built for pure convenience. This contrast isn't just a talking point; it's the reason chatbots are now essential for meeting modern customer expectations.

Let's look at a side-by-side comparison of how a common task gets done.

This table really drives home the efficiency gains. One path is full of frustrating delays, while the other offers an immediate resolution.

| Task | Traditional Method (Phone Call) | Chatbot Method (AI) | Key Advantage |

|---|---|---|---|

| Check a Transaction | 1. Dial number 2. Navigate IVR menu 3. Wait on hold (avg. 3-5 mins) 4. Verify identity with agent 5. Agent looks up info 6. Get answer |

1. Open chat window 2. Type "Show recent transactions" 3. Instantly authenticated 4. Receive transaction list |

Speed & Availability |

| Find Nearest ATM | 1. Open maps app separately 2. Search for bank 3. Sift through results |

1. Ask chatbot "Where is the nearest ATM?" 2. Chatbot provides map and address instantly |

Convenience |

| Hours of Operation | Available 9 AM - 5 PM on weekdays. Closed on holidays. | Available 24/7/365, including nights, weekends, and holidays. | Accessibility |

As you can see, the chatbot completely eliminates wait times, streamlines the process, and is always on—no matter the time of day. This is more than a small improvement; it's a fundamental upgrade to the service experience that directly boosts customer satisfaction and lowers operational costs.

When your bot handles the basics, your team is freed from the grind of repetitive questions. They can finally shift their energy toward building deeper, more meaningful relationships with your customers.

While handling everyday questions is a fantastic start, the real magic happens when chatbots for banks graduate from simple support to more complex, high-value roles. Modern AI isn't just a passive Q&A tool anymore; it’s an active partner that helps you grow the business, tighten security, and offer genuinely personal financial guidance. This is how your support channel becomes a strategic asset.

Think about the classic process of opening a new bank account. It's often slow, bogged down by paperwork, and usually requires a trip to a branch. Advanced chatbots completely flip this script by creating a smooth, digital onboarding experience. A new customer can kick things off whenever and wherever they want, right from a chat window.

The chatbot acts as a friendly guide, walking the user through each step with plain-language instructions. It handles critical tasks like Know Your Customer (KYC) verification by letting the user upload their ID documents directly in the chat. This automated flow is not just faster—it also cuts down on human error and keeps you compliant from day one.

Beyond onboarding, security is where these AI tools really shine. Instead of just reacting to fraud after the damage is done, they work proactively to stop it in its tracks. The AI learns a customer's typical transaction patterns—where they shop, how much they spend, when they’re active—and spots anything that looks out of place in real time.

For example, if a purchase pops up in another country while the customer’s phone shows they're at home, the chatbot can send an immediate alert.

This proactive approach is a game-changer for customer trust. It shows the bank is actively looking out for their money, transforming the chatbot from a simple helper into a vigilant security guard.

Perhaps the most exciting evolution is the chatbot’s new role as a personalized financial advisor. This is where AI stops just answering what customers already know to ask and starts offering insights they didn't even realize they needed. By connecting to a customer’s financial data, the bot can understand their specific situation and goals.

This is a central part of how to scale growth using AI customer service solutions, turning every support chat into a potential opportunity.

A customer might ask something complex, like, "What are the current rates for a 15-year fixed mortgage?" The chatbot can give them the answer and then follow up with a personalized offer based on their credit profile. Even better, it can make smart, unsolicited recommendations that add real value.

This level of personalization shows you truly understand your customer’s financial life. It’s no surprise that industry giants have seen incredible results with this model. Bank of America's Erica chatbot, for instance, has handled over 3 billion customer interactions. It automates up to 90% of inquiries, saves customers over 4 minutes per task, and can even boost first-contact resolution by 20%.

By stepping into these advanced roles, banking chatbots become indispensable. They streamline operations, bolster security, and—most importantly—create the kind of tailored experiences that build lasting loyalty and drive revenue.

Putting a sophisticated banking chatbot into place is a serious investment. So, how do you prove it’s actually paying off? We need to move past fuzzy promises of “better efficiency” and build a solid, data-driven way to measure the real-world financial impact. That means zeroing in on Key Performance Indicators (KPIs) that connect straight to your bottom line.

To get the full picture, you have to track how the chatbot is doing on its own and how it’s changing your entire support operation. These numbers don't just show you what you're saving; they reveal how you're building customer loyalty and increasing lifetime value.

First things first: you need a baseline. Before your chatbot ever talks to a customer, you have to know your current performance numbers inside and out. For example, document your current average call time and first-contact resolution rate. Once the bot is live, you can measure the difference and calculate a tangible return on your investment.

Here are the essential KPIs every bank should be watching:

Measuring these KPIs isn't just about creating charts for a presentation. It's about translating chatbot performance into actual dollars and cents. A 10% jump in your containment rate can easily translate into thousands of saved agent hours, giving your team the freedom to focus on high-value, revenue-generating work.

The real goal here is to draw a straight line from these operational metrics to tangible business results. For instance, a lower AHT and a higher FCR are the two main levers for reducing customer service costs in your contact center. When your chatbot handles 80% of the simple, repetitive questions, your agents are freed up to tackle complex issues like loan applications or wealth management advice—activities that directly grow your revenue.

The latest numbers paint a very clear picture of this financial impact. By 2025, with 92% of North American banks expected to have AI chatbots, these bots are already resolving 74% of interactions on the first try. They’re also handling 87% of inquiries in under a minute without needing a human, which is projected to create cumulative savings of $11 billion between 2025 and 2028. You can dig into more of these findings by exploring banking chatbot adoption statistics.

Finally, don’t forget about Customer Satisfaction (CSAT) scores. A quick survey after a chatbot interaction gives you a direct pulse on customer sentiment. When you see your CSAT scores climbing in connection with chatbot use, you have hard proof that you're not just cutting costs—you're building a better customer experience. And that’s what drives long-term loyalty and a higher customer lifetime value.

In banking, trust isn't just a part of the business—it's the entire foundation. When you bring a chatbot into the mix, you're not just opening another communication channel. You're asking customers to trust that their most sensitive financial details are safe inside an AI-powered conversation.

This means rock-solid security and airtight regulatory compliance are non-negotiable from day one.

You have to think "secure by design." It’s a lot like building a bank vault; you don’t put up the walls and then figure out where the steel door goes. Security has to be baked into the blueprint from the very beginning, leaving absolutely no weak points.

Protecting customer data demands a multi-layered defense. It’s not enough to secure just one piece of the puzzle—every single interaction has to be shielded. This requires a few technical safeguards that work together to build a fortress around your customer conversations.

These are the absolute must-haves for any banking chatbot:

Beyond the technical side, chatbots for banks have to operate within a complex web of global and local regulations. Designing for compliance isn’t an afterthought; it’s a core requirement that dictates how the chatbot is built and where the data lives. Get it wrong, and you’re looking at massive fines and, worse, a complete collapse of customer trust.

Building a compliant chatbot means treating data privacy as a fundamental customer right. The architecture must be designed to respect regulations like GDPR and CCPA, ensuring every interaction meets the highest standards of data protection.

Here’s a practical breakdown of the major regulations you'll encounter:

By baking these security and compliance principles into your AI strategy from the start, you do more than just manage risk. You send a clear message to your customers that their financial well-being is, and always will be, your top priority.

A great chatbot doesn't happen by accident. It's the result of a deliberate strategy that connects smart technology to real business results. Without a solid plan, even the most advanced chatbots for banks can end up frustrating customers instead of helping them. This blueprint breaks the process down into a practical, four-phase roadmap, guiding you from a simple idea to a fully optimized digital assistant.

Think of it like building a new bank branch. You wouldn’t just show up with a pile of bricks and hope for the best. You'd need architectural plans, a clear purpose, and a deep understanding of what your customers need. The same thoughtful approach is essential to make sure your chatbot becomes a valuable asset, not another customer service roadblock.

Before you even think about vendors or code, you have to define what success actually looks like. Vague goals like "improving efficiency" won't cut it. You need specific, measurable objectives that tie directly back to your bank's biggest priorities.

Setting these clear targets will steer every decision you make, from the features you choose to the way you design conversations. They also give you the hard numbers you need to measure ROI and prove the project's value to the higher-ups.

This is probably the most important decision you'll make in the entire process. You aren't just buying software; you're looking for a strategic partner who truly gets the financial services industry. The platform has to be secure, compliant, and ready to plug into your existing systems without a major headache.

The market for AI chatbots in banking is exploding, estimated to have hit $10-11 billion globally in 2023 and projected to soar past $27 billion by 2030. Financial institutions are clearly all-in on this technology, with 64% of platforms now supporting advanced features like fraud detection. You can dive deeper into these market trends and AI chatbot statistics.

When you're comparing partners, use this practical checklist:

This is where the magic really happens. A great banking chatbot conversation feels natural, genuinely helpful, and even a little bit empathetic. The goal is to guide users to answers quickly while always providing an easy escape route to a human when things get complicated.

Start by mapping out the main reasons customers contact you. Actionable Tip: Analyze your call center logs for the top 10 most frequent questions and build your initial chatbot flows around those. Most importantly, build a seamless human handoff from day one. The chatbot needs to be smart enough to recognize when a query is too complex or a customer is getting frustrated, and then intelligently pass the conversation—along with the full chat history—to a live agent. This one feature is absolutely critical for keeping customers happy.

You can learn more about structuring these handoffs by reviewing best practices for improving contact center operations.

Getting your chatbot live isn't the finish line; it’s the starting line. Don't try to boil the ocean on day one. Kick things off with a pilot program, rolling the chatbot out to a small group of customers or limiting it to just a few specific tasks. This lets you gather real-world feedback and iron out the kinks before a full-scale launch.

Once you go live, become obsessed with your analytics dashboard. Keep a close eye on your key metrics—containment rate, CSAT scores, and what's causing escalations. Actionable Insight: Look for "unanswered questions" in your analytics. If many users are asking about "wire transfer fees" and the bot doesn't have an answer, that's your top priority for the next update. Use these insights to tweak your dialogue, add new skills, and constantly make the experience better.

Even with the best plan in hand, it's natural to have a few lingering questions before making a big technology decision. Let's tackle some of the most common ones we hear from banking leaders to help clear up the final details.

This is a great question, and the answer lies in a smart, planned handoff. Modern banking chatbots know their limits. When a conversation gets too complex, or the AI senses a customer is getting frustrated, it doesn't just give up. It intelligently routes the entire conversation to the right human agent.

For example, if a customer says, "I need to dispute a charge, but it's part of a recurring subscription and I also lost my card," the chatbot should recognize the multiple issues and respond: "This sounds like something that needs a personal touch. I'm connecting you with a fraud specialist now."

The best part? The agent gets the full chat history instantly. No more "let me get you up to speed" from the customer.

The timeline really depends on how deep you want to go. A chatbot designed to answer common FAQs or check account balances can be up and running in just a few weeks. It's a quick win.

For a more ambitious project—like one that plugs directly into your core banking systems to handle transactions or onboard new customers—you're looking at a two-to-four month timeline. The good news is that today's platforms have a lot of pre-built connectors and guided setups that significantly speed things along.

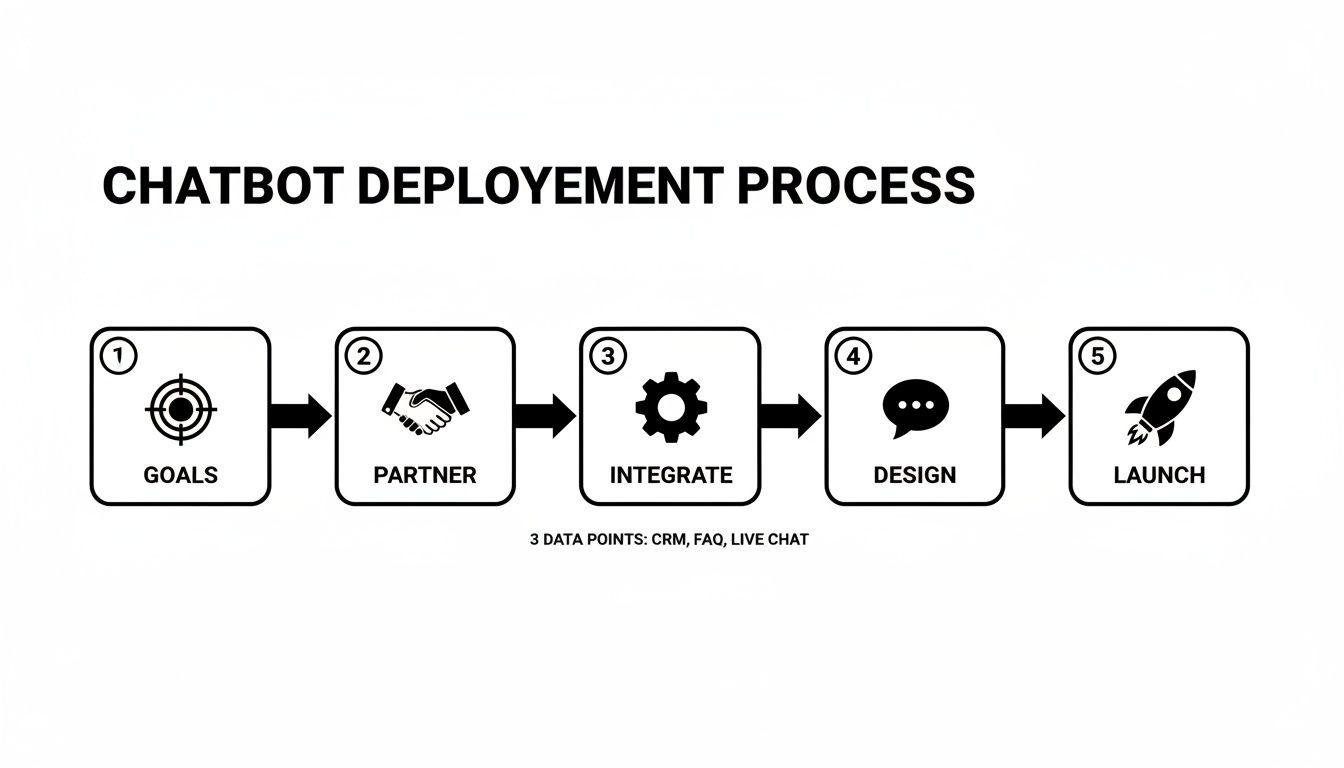

The diagram below gives you a bird's-eye view of the typical steps involved.

Following a clear process like this ensures your project stays on track and delivers exactly what your bank needs from day one.

Absolutely—and this is where they truly shine. By connecting the chatbot to your bank's CRM, it moves from a simple Q&A tool to a personal financial assistant.

It can greet customers by name, reference their past interactions, and offer genuinely helpful advice. Imagine a customer logs in and the chatbot says, "Welcome back, John. I see your car loan payment is due in three days. Would you like to pay it now?" That's the level of personalization we're talking about.

Making sure the bot sounds like you is a crucial part of the setup. You don't want a generic, robotic personality interacting with your customers. The platform can be trained using your existing brand style guides, marketing materials, and even transcripts of past support chats.

Actionable Tip: Create a simple "persona document" for your chatbot. Is it named "Fin"? Is it helpful and concise, or more detailed and educational? Give your development team clear examples of "say this, not that" to guide the bot's language. By setting the tone, you ensure every single automated interaction feels like a natural extension of your brand.

Ready to see how an empathy-first AI can turn your customer support from a cost center into a revenue driver? MagicalCX brings together sophisticated conversational AI and seamless agent handoffs to provide support that feels human, builds lasting loyalty, and fuels your growth. Learn more about MagicalCX and schedule your demo today!